Terrorism & Political Violence

Ultimately, businesses should be aware of the potential risks posed by terrorism and political violence and take proactive steps to protect their interests. Being informed, prepared, and adequately insured can make a significant difference in how a company navigates challenging situations.

Terrorism Insurance

Terrorism Insurance is a type of coverage designed to protect individuals, businesses, and other entities from financial losses resulting from acts of terrorism. In today's unpredictable world, where acts of terrorism can occur at any time and any place, having terrorism insurance can provide peace of mind and financial protection.

Acts of terrorism have the potential to cause widespread devastation and economic loss. From bombings to cyber-attacks, terrorism can target various sectors of society, including businesses, government institutions, and infrastructure. The financial impact of such events can be significant, leading to property damage, business interruption, and liability claims.

Terrorism Insurance policies typically provide coverage for property damage and business interruption resulting from acts of terrorism. Coverage may include physical damage to buildings, equipment, and other assets, as well as additional expenses incurred to resume business operations. Policies may also cover liability claims arising from third-party injuries or damage caused by a terrorist act.

Having terrorism insurance offers several benefits to policyholders. Firstly, it provides financial protection against the unforeseen and unpredictable nature of terrorist attacks. In the event of a covered loss, policyholders can rely on their insurance coverage to help cover repair costs, lost income, and other related expenses. Secondly, terrorism insurance can help businesses and entities meet regulatory requirements or contractual obligations that may require coverage for acts of terrorism. Lastly, having terrorism insurance can enhance an organization's resilience and risk management strategy, demonstrating a proactive approach to mitigating potential threats.

Political Violence Insurance

Political Violence Insurance is a specialized form of coverage designed to mitigate the financial risks associated with political instability and violence in various forms. Political violence is an unfortunate reality that poses substantial threats to businesses and individuals alike.

One of the key components of political violence insurance is coverage for property damage resulting from acts of terrorism, riots, civil commotion, or other politically motivated events. In regions where such risks are heightened, businesses face the potential for severe financial losses due to disrupted operations, property destruction, and subsequent losses.

Furthermore, political violence insurance often includes coverage for business interruption, a critical aspect for organizations that rely on continuous operations to generate revenue. In the aftermath of political upheaval, businesses may be forced to suspend operations temporarily or permanently due to safety concerns, infrastructure damage, or other disruptions. Business interruption coverage under political violence insurance can provide compensation for lost income, ongoing expenses, and additional costs incurred to resume operations in the aftermath of a covered event.

Moreover, political violence insurance can also extend coverage to liability risks arising from acts of terrorism or political violence, which may result in legal claims and lawsuits against affected parties. With liability coverage in place, policyholders can receive financial support for legal defense costs, settlements, and judgments should they be held accountable for damages caused by politically motivated events.

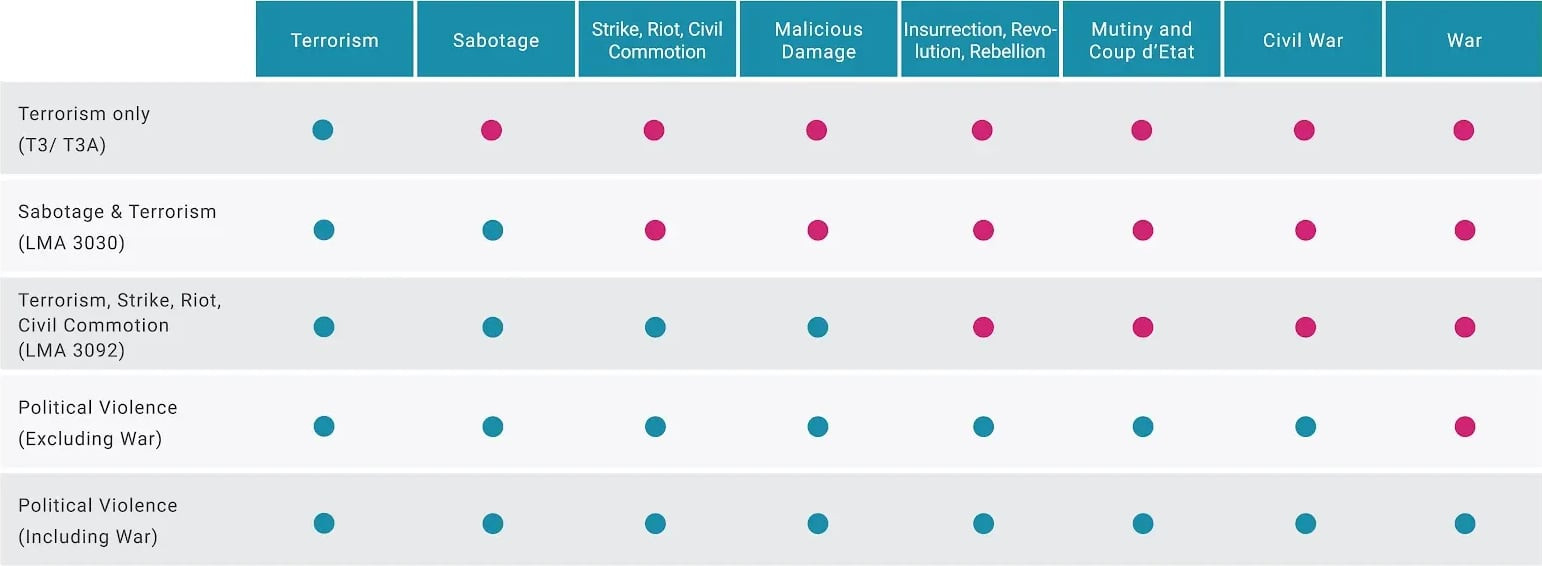

The following are key differences in the coverage and scope of

Terrorism and Political Violence Insurance:

AMG, we have extensive experience in the complex field of political violence insurance and can provide valuable insights and advice.

Our strength is our expertise in identifying, analyzing, negotiating and managing the following financial lines and special insurance products:

- Cash & Valuables in Transit

- Component Part Product Recall

- Contaminated Product Insurance (CPI)

- Crime Insurance

- Crop & Livestock

- Cyber Liability

- Directors & Officers Liability

- Environmental Liability

- Event Cancellation

- Fine Art and Collectibles

- Investment Manager Professional Indemnity (IMPI)

- Jewellers Block

- Kidnap and Ransom

- Manufacturers Errors and Omissions (E&O)

- Medical Malpractice

- Product Liability

- Professional Indemnity

- Single Project Professional Indemnity

- Terrorism & Political Violence

- Trade Credit

Contact AMG

We provide risk management, risk consulting, insurance broking, insurance program management and claims advocacy services.